Trusted Financial Advisor to the Renewable Energy Industry

Virentis Advisors is a boutique investment banking firm serving clients in the renewable energy sector, with unique experience and a niche focus on the bioenergy industry.

Virentis Advisors is a boutique investment banking firm serving clients in the renewable energy sector, with unique experience and a niche focus on the bioenergy industry.

Our Services

Virentis Advisors has deep expertise across project finance, deal structuring, sourcing of debt and equity, tax credit monetization, tax planning, and project development.

Sourcing and negotiation of all or portions of capital requirements including senior debt, subordinated debt/mezzanine, equity (sourced from institutions and strategics). Experience with capital providers including:

Virentis has an existing and expanding network of tax investors with interest in supporting the bioenergy industry. Services offered to project owners and tax credit investors include:

About Us

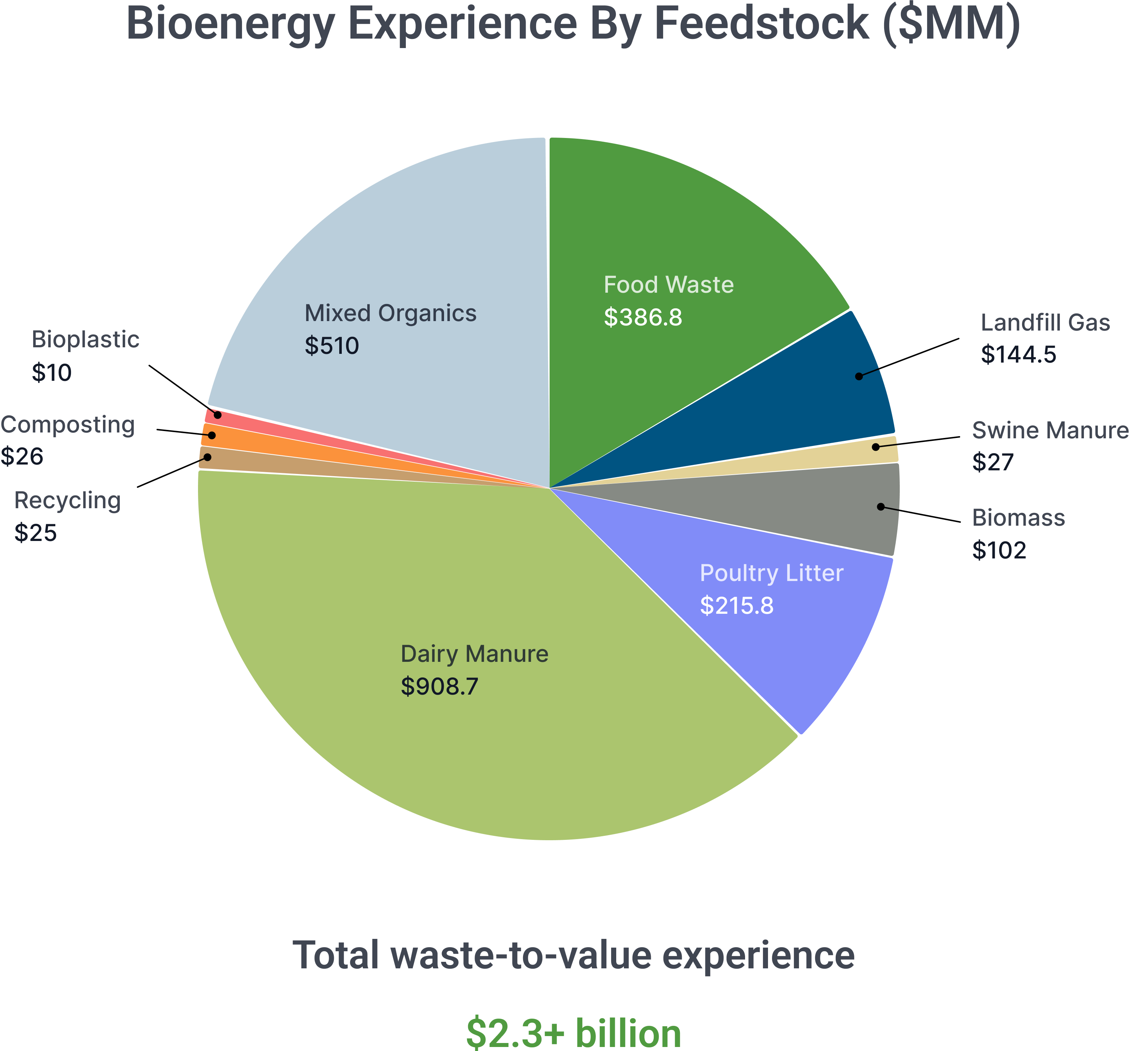

Virentis Advisors’ partners have over $7.2 billion of project experience since 2008 across the renewable energy spectrum – wind, solar, hydro, biomass, biogas, biofuels and geothermal. Over $2.3 billion of these projects have been in the bioenergy industry.

Virentis focuses on supporting client's capital needs within the bioenergy industry, using our principals' collective experience.

Virentis works with a wide range of renewable energy and sustainable infrastructure clients, including project developers, waste companies, oil and gas companies, food and beverage manufacturers, utilities, and municipalities.

Certain Virentis principals have Series 79 and 63 securities licenses and are registered representatives through DCF, LLC, Member FINRA and SIPC.

IRA 22 Impact

Unlocking the Potential: How the Inflation Reduction Act of 2022 (IRA 22) Transforms the Bioenergy Landscape

Dynamic Impact IRA 22’s impact on the bioenergy industry has already

been dramatic and has enabled bioenergy tax credits to become a true asset class.

Larger ITCs / PTCs Bioenergy projects can now earn larger Investment

Tax Credits & Production Tax Credits (ITCs and PTCs) worth up to 50%, as well as new 45Z PTC for clean fuels production.

Broad Application There is now broad application of significant

federal tax incentives to projects utilizing organic matter to produce energy; ITCs and PTCs now apply to projects producing biofuels used for transportation or heating purposes which previously only applied to projects which generated electricity.

Economic Strength Impact of ITC/45Z provisions can mean a 25-40%

net reduction of project capital needs and increase revenue generation by 10-35%, whichwhich enables a sector experiencing dramatic growth to become even stronger economically.

Our Experience

Virentis is focused on supporting the capital needs of clients within the bioenergy industry and is building on the principals’ collective experience with bioenergy projects that have been built or are under construction including:

Transactions

Client:

Food Waste to RNG Facility

Funding Party:

Private Equity / Consortium of 3 Lenders

Client:

Food Waste to RNG Facility

Funding Party:

Health Insurance Company

ITC Amount:

$17.73M

Client:

Food Waste to RNG Facility

Funding Party:

Health Insurance Company

| Close Date: | December 2023 |

| Transaction Type: | Tax Credit Transfer (ITC) |

| ITC Size: | $17.73 |

| ITC Amount: | $17.73M |

| Project Location: | Southeastern US |

| Step Up: | Development Fee |

| Prevailing Wage & Apprenticeship: | Yes |

| Domestic Content: | No |

| Energy Community: | No |

Client:

Dairy to RNG Facility

Funding Party:

Fintech Company

ITC Amount:

$10.89M

Client:

Dairy to RNG Facility

Funding Party:

Fintech Company

| Close Date: | December 2023 |

| Transaction Type: | Tax Credit Transfer (ITC) |

| ITC Size: | $10.89M |

| ITC Amount: | $10.89M |

| Project Location: | Southeastern US |

| Step Up: | No |

| Prevailing Wage & Apprenticeship: | Yes |

| Domestic Content: | Yes |

| Energy Community: | No |

Client:

Food Waste to RNG Facility

Funding Party:

Health Insurance Company

ITC Amount:

$46.21M

Client:

Food Waste to RNG Facility

Funding Party:

Health Insurance Company

| Close Date: | January 2024 |

| Transaction Type: | Tax Credit Transfer (ITC) |

| ITC Size: | $46.21M |

| ITC Amount: | $46.21M |

| Project Location: | Eastern US |

| Step Up: | No |

| Prevailing Wage & Apprenticeship: | Yes |

| Domestic Content: | Yes |

| Energy Community: | No |

Client:

Dairy to RNG Facility

Funding Party:

Fintech Company

ITC Amount:

$10.64M

Client:

Dairy to RNG Facility

Funding Party:

Fintech Company

| Close Date: | January 2024 |

| Transaction Type: | Tax Credit Transfer (ITC) |

| ITC Size: | $10.64M |

| ITC Amount: | $10.64M |

| Project Location: | Southeastern US |

| Step Up: | No |

| Prevailing Wage & Apprenticeship: | Yes |

| Domestic Content: | Yes |

| Energy Community: | Yes |

Client:

Dairy to RNG Facility

Funding Party:

Foodservice Company

ITC Amount:

$1.05M

Client:

Dairy to RNG Facility

Funding Party:

Foodservice Company

| Close Date: | June 2024 |

| Transaction Type: | Tax Credit Transfer (ITC) |

| ITC Size: | $1.05M |

| ITC Amount: | $1.05M |

| Project Location: | Western US |

| Step Up: | No |

| Prevailing Wage & Apprenticeship: | Yes |

| Domestic Content: | No |

| Energy Community: | No |

Client:

Dairy to RNG Facility

Funding Party:

Foodservice Company

ITC Amount:

$1.76M

Client:

Dairy to RNG Facility

Funding Party:

Foodservice Company

| Close Date: | June 2024 |

| Transaction Type: | Tax Credit Transfer (ITC) |

| ITC Size: | $1.76M |

| ITC Amount: | $1.76M |

| Project Location: | Western US |

| Step Up: | No |

| Prevailing Wage & Apprenticeship: | Yes |

| Domestic Content: | No |

| Energy Community: | Yes |

Client:

Dairy to RNG Facility

Funding Party:

Foodservice Company

ITC Amount:

$2.27M

Client:

Dairy to RNG Facility

Funding Party:

Foodservice Company

| Close Date: | June 2024 |

| Transaction Type: | Tax Credit Transfer (ITC) |

| ITC Size: | $2.27M |

| ITC Amount: | $2.27M |

| Project Location: | Western US |

| Step Up: | No |

| Prevailing Wage & Apprenticeship: | Yes |

| Domestic Content: | Yes |

| Energy Community: | Yes |

Client:

Dairy to RNG Facility

Funding Party:

Foodservice Company

ITC Amount:

$2.11M

Client:

Dairy to RNG Facility

Funding Party:

Foodservice Company

| Close Date: | June 2024 |

| Transaction Type: | Tax Credit Transfer (ITC) |

| ITC Size: | $2.11M |

| ITC Amount: | $2.11M |

| Project Location: | Western US |

| Step Up: | No |

| Prevailing Wage & Apprenticeship: | Yes |

| Domestic Content: | Yes |

| Energy Community: | Yes |

Client:

Dairy to RNG Facility

Funding Party:

Foodservice Company

ITC Amount:

$1.49M

Client:

Dairy to RNG Facility

Funding Party:

Foodservice Company

| Close Date: | June 2024 |

| Transaction Type: | Tax Credit Transfer (ITC) |

| ITC Size: | $1.49M |

| ITC Amount: | $1.49M |

| Project Location: | Western US |

| Step Up: | No |

| Prevailing Wage & Apprenticeship: | Yes |

| Domestic Content: | Yes |

| Energy Community: | No |

Client:

Dairy to RNG Facility

Funding Party:

Foodservice Company

ITC Amount:

$1.82M

Client:

Dairy to RNG Facility

Funding Party:

Foodservice Company

| Close Date: | June 2024 |

| Transaction Type: | Tax Credit Transfer (ITC) |

| ITC Size: | $1.82M |

| ITC Amount: | $1.82M |

| Project Location: | Western US |

| Step Up: | No |

| Prevailing Wage & Apprenticeship: | Yes |

| Domestic Content: | Yes |

| Energy Community: | No |

Client:

Dairy to RNG Facility

Funding Party:

Foodservice Company

ITC Amount:

$1.25M

Client:

Dairy to RNG Facility

Funding Party:

Foodservice Company

| Close Date: | June 2024 |

| Transaction Type: | Tax Credit Transfer (ITC) |

| ITC Size: | $1.25M |

| ITC Amount: | $1.25M |

| Project Location: | Western US |

| Step Up: | No |

| Prevailing Wage & Apprenticeship: | Yes |

| Domestic Content: | Yes |

| Energy Community: | No |

Client:

Dairy to RNG Facility

Funding Party:

Foodservice Company

ITC Amount:

$1.68M

Client:

Dairy to RNG Facility

Funding Party:

Foodservice Company

| Close Date: | June 2024 |

| Transaction Type: | Tax Credit Transfer (ITC) |

| ITC Size: | $1.68M |

| ITC Amount: | $1.68M |

| Project Location: | Western US |

| Step Up: | No |

| Prevailing Wage & Apprenticeship: | Yes |

| Domestic Content: | Yes |

| Energy Community: | No |

Client:

Food Processing Waste to CHP Facility

Funding Party:

Regional Bank

ITC Amount:

$1.94M

Client:

Food Processing Waste to CHP Facility

Funding Party:

Regional Bank

| Close Date: | July 2024 |

| Transaction Type: | Tax Credit Transfer (ITC) |

| ITC Size: | $1.94M |

| ITC Amount: | $1.94M |

| Project Location: | Midwestern US |

| Step Up: | No |

| Prevailing Wage & Apprenticeship: | Yes |

| Domestic Content: | No |

| Energy Community: | Yes |

Client:

Food Processing Waste to CHP Facility

Funding Party:

Regional Bank

ITC Amount:

$1.43M

Client:

Food Processing Waste to CHP Facility

Funding Party:

Regional Bank

| Close Date: | July 2024 |

| Transaction Type: | Tax Credit Transfer (ITC) |

| ITC Size: | $1.43M |

| ITC Amount: | $1.43M |

| Project Location: | Midwestern US |

| Step Up: | No |

| Prevailing Wage & Apprenticeship: | Yes |

| Domestic Content: | No |

| Energy Community: | No |

Client:

Food Processing Waste to CHP Facility

Funding Party:

Regional Bank

ITC Amount:

$2.81M

Client:

Food Processing Waste to CHP Facility

Funding Party:

Regional Bank

| Close Date: | July 2024 |

| Transaction Type: | Tax Credit Transfer (ITC) |

| ITC Size: | $2.81M |

| ITC Amount: | $2.81M |

| Project Location: | Midwestern US |

| Step Up: | No |

| Prevailing Wage & Apprenticeship: | Yes |

| Domestic Content: | No |

| Energy Community: | Yes |

Client:

Dairy to RNG Facility

Funding Party:

Consortium of Regional Banks

ITC Amount:

$3.09M

Client:

Dairy to RNG Facility

Funding Party:

Consortium of Regional Banks

| Close Date: | September 2024 |

| Transaction Type: | Tax Credit Transfer (ITC) |

| ITC Size: | $3.09M |

| ITC Amount: | $3.09M |

| Project Location: | Northeastern US |

| Step Up: | No |

| Prevailing Wage & Apprenticeship: | Yes |

| Domestic Content: | No |

| Energy Community: | No |

Client:

Dairy to RNG Facility

Funding Party:

Regional Bank

ITC Amount:

$28.27M

Client:

Dairy to RNG Facility

Funding Party:

Regional Bank

| Close Date: | September 2024 |

| Transaction Type: | Tax Credit Transfer (ITC) |

| ITC Size: | $28.27M |

| ITC Amount: | $28.27M |

| Project Location: | Southern US |

| Step Up: | No |

| Prevailing Wage & Apprenticeship: | Yes |

| Domestic Content: | No |

| Energy Community: | Yes |

Client:

Dairy to RNG Facility

Funding Party:

Fintech Company

ITC Amount:

$3.07M

Client:

Dairy to RNG Facility

Funding Party:

Fintech Company

| Close Date: | September 2024 |

| Transaction Type: | Tax Credit Transfer (ITC) |

| ITC Size: | $3.07M |

| ITC Amount: | $3.07M |

| Project Location: | Northeastern US |

| Step Up: | No |

| Prevailing Wage & Apprenticeship: | Yes |

| Domestic Content: | No |

| Energy Community: | No |

Client:

Poultry Litter to Electricity Facility

Funding Party:

Insurance Company

ITC Amount:

$29.36M

Client:

Poultry Litter to Electricity Facility

Funding Party:

Insurance Company

| Close Date: | December 2024 |

| Transaction Type: | Tax Credit Transfer (ITC) |

| ITC Size: | $29.36M |

| ITC Amount: | $29.36M |

| Project Location: | Eastern US |

| Step Up: | Yes |

| Prevailing Wage & Apprenticeship: | Yes |

| Domestic Content: | Yes |

| Energy Community: | Yes |

Client:

Poultry Litter to Electricity Facility

Funding Party:

Insurance Company

ITC Amount:

$29.00M

Client:

Poultry Litter to Electricity Facility

Funding Party:

Insurance Company

| Close Date: | December 2024 |

| Transaction Type: | Tax Credit Transfer (ITC) |

| ITC Size: | $29.00M |

| ITC Amount: | $29.00M |

| Project Location: | Eastern US |

| Step Up: | Yes |

| Prevailing Wage & Apprenticeship: | Yes |

| Domestic Content: | Yes |

| Energy Community: | Yes |

Client:

Poultry Litter to Electricity Facility

Funding Party:

Infrastructure Fund / Regional Bank

Client:

Poultry Litter to Electricity Facility

Funding Party:

Infrastructure Fund / Regional Bank

Client:

Dairy to RNG Facility

Funding Party:

Regional Bank

ITC Amount:

$8.25M

Client:

Dairy to RNG Facility

Funding Party:

Regional Bank

| Close Date: | January 2025 |

| Transaction Type: | Tax Credit Transfer (ITC) |

| ITC Size: | $8.25M |

| ITC Amount: | $8.25M |

| Project Location: | Southern US |

| Step Up: | No |

| Prevailing Wage & Apprenticeship: | Yes |

| Domestic Content: | No |

| Energy Community: | Yes |

Client:

Landfill Gas to RNG Facility

Funding Party:

Regional Bank

ITC Amount:

$12.5M

Client:

Landfill Gas to RNG Facility

Funding Party:

Regional Bank

| Close Date: | June 2025 |

| Transaction Type: | Tax Credit Transfer (ITC) |

| ITC Size: | $12.5M |

| ITC Amount: | $12.5M |

| Project Location: | Southeast US |

| Step Up: | No |

| Prevailing Wage & Apprenticeship: | Yes |

| Domestic Content: | Yes |

| Energy Community: | No |

Client:

Dairy to RNG Facility

Funding Party:

Multinational Investment Bank

ITC Amount:

$36.9M

Client:

Dairy to RNG Facility

Funding Party:

Multinational Investment Bank

| Close Date: | June 2025 |

| Transaction Type: | Tax Credit Transfer (ITC) |

| ITC Size: | $36.9M |

| ITC Amount: | $36.9M |

| Project Location: | Mountain West |

| Step Up: | No |

| Prevailing Wage & Apprenticeship: | Yes |

| Domestic Content: | Yes |

| Energy Community: | No |

Bioenergy Industry

Bioenergy is a form of renewable energy that is derived from recently living organic materials

known as biomass, which can be used to produce transportation fuels, heat, electricity and other products.

Bioenergy projects have the unique ability to de-carbonize multiple sectors of the economy with

the energy they produce (power, transportation, manufacturing, waste management, commercial and industrial purposes).

The bioenergy industry has the ability to reduce more carbon emissions, provide direct Scope 1, 2 and 3 benefits and satisfy more ESG mandates per dollar of invested capital than other renewable energy asset classes due to its low “carbon intensity”.

Our Mission

The energy transition is under way, and Virentis is dedicated to driving supportive financial innovation.

At Virentis, we believe that organizations must approach this transition to sustainability with the fundamental belief that effective change is actually possible. The work effort requires financial discipline and informed decision making, so that the changes being implemented remain economically viable. Virentis was created to support organizations as they implement transformative improvements, accelerating the shift to a circular economy and creating positive impact that benefits not only themselves, but the communities they serve.

Our Team

Virentis formed in 2022 with these former leaders of nationally known energy advisor, investment banks, and senior lenders.

Managing Partner

Over 30 years investment banking, 15 years founding and leading renewable energy practice at national accounting firm.

Mike has more than 30 years of experience providing financial advisory and private investment banking services to clients, the last 16 years focused exclusively on the energy and infrastructure industry. This includes development support, deal structuring, tax credit monetization, grant procurement, funding placement of both equity and debt and general corporate finance consulting.

Mike assists clients in a wide range of energy sectors including utilities, manufacturers, universities, municipalities and developers. Scope of assistance typically includes a lead role in the project/transaction, including:

Mike recently founded Virentis Advisors (November 2022). Prior to Virentis,Mike was with a national CPA firm for 24 years, and was an original founder of that firm’s renewable energy and infrastructure practice in late 2007. During his tenure with that firm, the group he lead supported over 200 projects that are either built or under construction, ranging from $5 million to $400 million and totaling more than $4.21 billion of construction value. These projects include energy from waste, biomass, wind, solar, hydro and geothermal heating and cooling.

Prior to 2007, Mike advised clients on more than $350 million of completed transactions across a wide variety of industries.

Industry Involvement

Managing Partner

12 years in renewable energy banking, 9 years at a national lender founding and leading the bioenergy lending group.

Max is an investor, developer, and capital advisor in the sustainable infrastructure and renewable energy sectors, bringing 12 years of experience to the firm.

He previously spent nine years with Live Oak Bank (NYSE: LOB), most recently as an SVP, where he started a lending vertical dedicated to projects and developers across the bioeconomy, with a specialty in project finance and government guaranteed loans (SBA, USDA, DOE).

Max recently became a minority investor and CFO of a bioenergy project development company which focuses on public-private partnerships with municipalities to convert landfill gas (carbon dioxide and methane) into energy, fuel, and useful products.

Prior to Live Oak he briefly worked in Mass Mutual’s advisory division with a registered investment advisor. He is currently studying for his FINRA Series 79 securities license.

Industry involvement

Managing Partner

Chris brings 20 years of corporate tax advisory and tax equity financing experience to the firm; providing private investment banking services to clients in the renewable energy industry with focus on the bioenergy space. Scope of assistance typically includes:

Prior to joining Virentis Advisors, Chris spent a year with Baker Tilly Capital’s Energy and Infrastructure group, and 5 years with the Leasing and Asset Financing business within MUFG Union Bank’s investment bank. Key responsibilities included:

From 2006-2016 Chris worked as a Senior Manager in KPMG’s national Tax Transformation practice in addition to holding various managerial roles in corporate tax, specializing in tax reporting (SOX 404) partnership taxation. In his role at KPMG:

Licenses/Certifications

FINRA Series 79 and 63 licenses

To receive additional information about our firm and start the conversation, please fill out this form and one of our principals will respond as soon as possible.

We’ll get back to you shortly.

In the meantime, explore the newest case studies from our clients. Our team is here to help you replicate their success for your business.